Part 3: EV Charging Infrastructure in India – Strategic Recommendations

Raghav Bharadwaj

Head of Strategy and Leadership

Read BOLT's recommendations to Indian officials to support India's EV charging growth.

This is the third part of BOLT's three-part analysis of India's EV charging infrastructure.

At BOLT, we conducted a three-part market analysis on the electric vehicle (EV) charging infrastructure in India. The first article established the current state of EV and EV charging in India. In the second, we discussed the opportunities and risks of increased EV adoption in India. From these two articles, it's clear that EV charging infrastructure is set to grow in India.

Now, we'll highlight some key strategic recommendations. We also hope this helps officials to make better decisions around the EV charging infrastructure.

Maximizing the Economic Impact of the EV Transition in India: Possible Scenarios

India is a key market to represent the transition to electric mobility in the coming decade. More specifically, it can lead the way on how emerging economies should reach this goal.

We can somewhat compare the EV and EV charging infrastructure worldwide to the smartphone market. Developed and emerging economies have starkly different mobility and charging needs. For instance, the share of 2-wheelers is much larger in emerging economies. This mirrors the dominance of the two largest smartphone operating systems--iOS and Android.

In the long run, we believe the same will happen to the operating systems that power EVs and EV charging infrastructure. Clear leaders will likely emerge for the two distinct markets. Although market shares among different geographies may overlap, the difference will be clear. While some EV and Charger Operating Systems will offer an open-source, peer-to-peer charging experience, others may create a closed ecosystem of charging services, depending on the local EV user base.

Given the advent of EVs, we can also project a few main transitions that could happen to the mobility sector in India. Namely, we'll list these 3 scenarios and what they could mean to the EV charging infrastructure in India:

1. EVs on the Road Outstrip the Needed EV Charging Infrastructure

While this scenario is unlikely, this would be the worst possible outcome. India will have to deploy an efficient EV charging infrastructure on time. Otherwise, EV charging will snowball into a costly endeavor. A big chunk of public charging infrastructure investment could also become a sunk cost. This will all slow down EV adoption even further. Ultimately, the country could miss the EV30@30 pledge it has made in this scenario.

2. Unplanned Deployment of EV Charging Infrastructure Creates Inefficient Public Charging Networks

Deploying an efficient nationwide charging network needs several considerations. Additionally, infrastructure deployment requires a massive collaboration. Specifically, the government, utilities, private/ public companies, startups, and the media should all work together.

End-users use public EV charging infrastructure far less than gas/petrol stations. The country needs a highly optimized strategy for deployments. Otherwise, some chargers on the network could get isolated. This will certainly lead to a sunk cost. Additionally, for EV charging infrastructure to be efficient, the positioning of fast and slow chargers needs to be optimal. An inefficient approach would limit EV adoption rates around hyper-localized regions.

3. India Leads the Way for Emerging Economies

Deploying a nationwide charging network is challenging. However, India should look at this as a necessary task. This is also an opportunity to market a successful EV business model. Other emerging economies can then use this model.

Consumers' EV charging needs vary vastly across different countries. This means India can't deploy an inexpensive version of a Western business model. Rather, the country should encourage a "leading" kind of EV ecosystem. The rest of the world should want to reference India's business model.

Before planning a nationwide EV charging network, decision-makers have a few things to consider. Let's take a deeper look at some of the key considerations.

3 Factors to Consider When Planning India's EV Charging Infrastructure

1. Business Model: Creating an EV Charging Marketplace

Current Scenario

The Centre for Climate and Energy Solutions states that charging stations can't possibly rely on direct revenue from EV charging services. Most EV charging happens privately at home, so it isn't financially feasible.

To ensure mass rollouts globally, governments have favored EV charging businesses. In some cases, these businesses are exempt from regulations on utilities. In others, they operate as pure commercial service businesses.

What does this mean? EV charging infrastructure providers give electricity to consumers. However, they aren't tied to the regulations that utilities need to follow. As a result, this creates a lower entry barrier in the charging infrastructure market

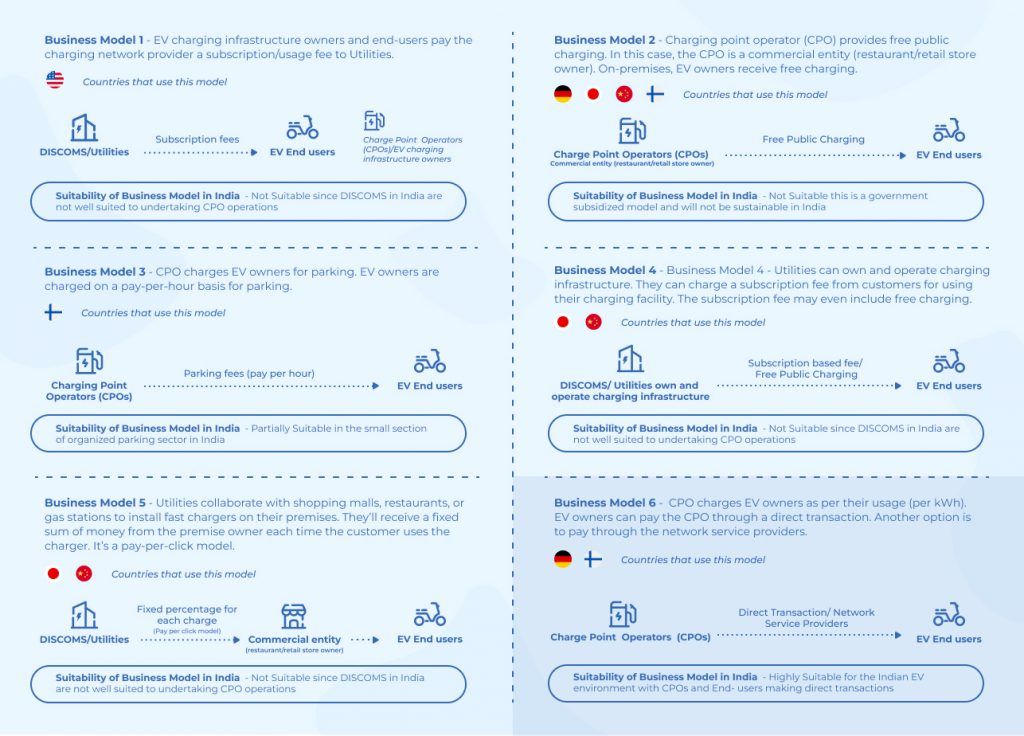

Many new business models around charging have also started to emerge across the globe. Below, we take a look at some of the most common of these business models. We'll also see how applicable they are to India.

6 Business Model Examples

Below are the 6 most common EV charging business models found across the globe.

Slow chargers aren't highly cost-intensive per unit. However, the volumes of slow chargers needed in India are extremely high since India has a large share of 2- and 3-wheeled EVs. Additionally, fast chargers can require a much higher initial capital cost to deploy, almost 10 to 100 times that of slow chargers. This means that making charging stations profitable would require a strategic approach. That's especially true in emerging economies where consumers are also highly cost-conscious.

The involved cost structures are also high. Distribution companies (DISCOMs) in India aren't currently ready for the EV transition yet. That means the ideal solution for India is to adopt Germany and Finland's business models. India should promote a marketplace model where CPOs and EV users make direct transactions.

2. Quantifying Charging Needs for a City

Next, India will have to consider the actual execution of charger deployment. Historically speaking, EV charging infrastructure around the world is expanding outward from Tier 1 cities. Thus, to plan EV charging infrastructure deployment, a necessary step is to define and quantify the following key criteria:

Charging Loads to the Existing Electricity Infrastructure

As the number of EVs on the road grows, the load on the electrical grid will also increase. Planning authorities need to understand this data, then execute grid balancing operations accordingly.

EV End-User Battery Charging Patterns and Behaviors

EV charging patterns will vary drastically from petrol/gas stations. Most EV users will charge their vehicles at home or at work. This means the charging behavior of users is also critical to understand. Utilities should know when they'll face higher loads from EV charging depending on the time of day, geographical location, and so on. India needs to identify the peak EV load demands at each time of the day. Then, this will help offset any grid failures.

Slow and Fast Chargers in Different Locations

India specifically requires fast charging along highway routes. The country also needs a dense network of slow chargers in more populated areas. Fast chargers placed strategically within city limits will be a valuable add-on. However, this wouldn't restrict EV adoption largely if unavailable immediately. India needs to identify the most optimized charger placement. To do this, the country should consider charger types, numbers needed, and user behavior. This will also be critical to meeting charging demand.

The Need for EV Chargers Will Increase Soon

City-level planning authorities need to consider the fact that the 'ubiquity of chargers' can solve many issues. That includes charger availability, charger malfunctions, and so on. One good metric to understand these needs is the predicted total number of chargers needed in a year. Similarly, the country will need to consider the year-on-year increase in peak EV loads. This will help predict the number of chargers needed as the EV market in India grows.

Updates to the Electricity Grid To Handle Future Loads

The EV market is fairly new to India. Yet, by 2030, the peak loads could be far larger than what the current electricity grid infrastructure can support. Additionally, any investment into renewable energy-based charging solutions might also warrant a similar infrastructure upgrade. Thus, the country needs** city-level grid planning**. Investments should also be based on EV adoption throughout the year. This will all be critical to understanding the costs involved now and in the future.

City-level planning will aid in the efficient execution of charging infrastructure deployment. However, decision-makers need to look into some additional considerations, specifically around Indian consumer behaviors. Many aspects of the Indian EV ecosystem need to be carefully crafted around these consumer patterns. In the next section, we take a more detailed look at these behaviors. We'll also see how they impact charging infrastructure deployment.

3. The Indian EV Consumer

Many Indian consumers are interested in and willing to buy EVs. Namely, their motivation is to battle climate change. Likewise, the same consumers have technological adoption concerns. As a result, they're reluctant to transition to EVs. Below are some key considerations that help potential EV customers in India adopt this technology:

Indian Automobile Consumers Care About Initial/Running Costs

Indian automobile consumers are extremely conscious of the initial cost of entry. They also care about running costs. OEMs manufacturing EVs locally can gain subsidies, which can help lower the customer's total ownership costs. On the charging side, consumers are likely to prefer slow chargers. They're also incentivized to opt-in for any subsidies available on electricity tariffs.

2- And 3-Wheeled EVs Are Well-suited for Indian Roads

EVs are generally well-suited to Indian driving conditions. Within the 2- and 3-wheeled EV segments, the switch to EVs is growing. These vehicle types have smaller battery capacities and they're suited for slow charging standards. As a result, 2- and 3-wheelers are likely to demand charging infrastructure first.

Lacking Awareness of Consumers

Potential EV customers in India still lack a certain level of awareness. They don't know about range anxiety, battery life, and charging availability. Customers won't face these issues with value-added services. They could get route planning options and real-time information on charge point locations and charging costs. However, this will require a comprehensive educational initiative across government and media to help ease the transition to new technology.

Simple Payment Management Systems

EV Charging also needs a simple and easy-to-use payment system integrated with a charger management system. These should also track and document all direct transactions between charging point owners and EV users. Additionally, with several EV charger plug types currently in use), charging point operators should also focus on compatibility. This will help cater to a wider variety of vehicle types.

Now that we've seen the 3 factors to consider before rolling out an EV charging infrastructure in India, let's dive into our recommendations.

Recommendations

After discussing these strategic considerations, we at BOLT also have some further recommendations for EV charging infrastructure. We've separated them into 4 categories:

1. The Government Needs To:

- Develop a comprehensive strategy for nationwide public EV Charging infrastructure deployment

- Refine regulations around electricity distribution for EV charging

- Align private and public EV ecosystem players towards India's unique needs arising from the higher population density and relatively smaller average distances traveled by commuters daily

- Clarify the long-term role of state-owned utilities and DISCOMs in setting up EV charging infrastructure

- Specify regulations around grid services and vehicle-grid integration

- Address citizens' concerns about range anxiety and EV charging infrastructure issues

- Inform citizens about the environmental and cost benefits of transitioning to EVs

2. The EV Industry and Ecosystem Needs To:

- Address the immediate need for 2- and 3-Wheeler EVs and the consequently required charging infrastructure, with a safe and connected experience

- Deploy and maintain large charging point networks and cater to the demand for chargers up to 2030 and beyond (for CPOs)

- Educate citizens about range anxiety and EV charging infrastructure issues and about the benefits of transitioning to EVs

3. The DISCOMs Need To:

- Develop programs with CPOs/MSPs that encourage customers to notify DISCOMs when they register a new EV or buy an automated charging point for public use

- Offer incentives for charging systems with some automated control capabilities to gain network visibility into EV charging demands

- Offer the right signals to the user, enabling them to choose the best charging option that includes time-of-use or location-based price signals to manage grid loads effectively

- Educate citizens on incentives and subsidies for EVs and EV charging

4. The Media Needs To:

- Highlight the right educational stories around alleviating concerns among EV users about range anxiety, charger availability, cost of ownership, and so on

- Assist in democratizing information about the technology transition to EVs, the new charging paradigm, and the benefits of making this switch

When the citizens are well-informed, it'll be easy to convince them to transition to EVs. In turn, the market will also benefit from the booming EV charging infrastructure. Then, India will be at the forefront of the ongoing global transition to clean transport.

To Summarize

In this final part of our 3-part EV charging infrastructure series, we've discussed our recommendations for EV charging infrastructure deployment. We've also showcased the necessary factors the city supervisory body should consider in implementing the EV charging infrastructure. This third installation has also outlined BOLT's recommendations to bolster EV charging infrastructure growth. We hope the government, industry, DISCOMs, and other related parties consider our findings. Adhering to an optimized plan will surely help India reach its EV30@30 pledge.

In all, we've been able to address all the risks and summarize all the opportunities that will come from the EV transition. Our mission at BOLT is to ensure the proper growth of India's EV charging infrastructure. To that end, we hope our market analysis has brought enough awareness to India's EV users and governmental officials.

FAQ

What should the Indian government do to support the EV charging infrastructure?

The government should inform citizens about the potential issues in the country's EV infrastructure. It should also showcase the health and cost benefits of adopting EVs. That'll enable citizens to head towards EVs, which also creates EV charging infrastructure opportunities.What are some business models in the EV charging marketplace?

Some stores may offer free charging, and it increases attraction to their business. Other companies may also adopt a subscription fee model where the owners and end-users pay the provider a fee. In all, these business models can support a country's EV charging infrastructure growth.What are some opportunities for the EV charging infrastructure?

As India's EV charging infrastructure grows, it'll create many opportunities in the market. For example, data analytic businesses can emerge to assist CPOs and DISCOMs. Solar energy-powered stations can also pop up to support the EV charging infrastructure. Contact BOLT to learn more about the best EV charging infrastructure solutions.What are some risks in the EV sector?

The EV charging infrastructure in India may face many risks. For example, there may be reduced revenue from the fossil fuel tax. 25% of the central government's revenue comes from this tax. The EV charging infrastructure also lacks regulations and clarity. This makes cross-platform usage hard to achieve.What EV type is prominent in the Indian market as of 2022?

2- and 3-wheeler EVs lead the Indian market in sales volumes (34% for 2-wheelers and 33% for 3-wheelers). These EVs need smaller battery capacity and can use standard AC outlets to charge. These EVs also help lower carbon emissions, so they're better for the environment. Finally, 2 and 3-wheeler EVs have lower running costs.Resources

BOLT: Part 1: EV Charging Infrastructure

Discover our assessment of India's EV charging infrastructure.

BOLT: Part 2: EV Charging Infrastructure

Learn about the business opportunities and risks for India's EV charging infrastructure.

BOLT: Our Partners

Find out who's supporting BOLT in developing India's EV charging infrastructure.

BOLT: BOLT OS

Get the best EV charging network app.

BOLT: Guide to Install a Home EV Charger

Learn how you can install a home EV charger from BOLT.